In today’s competitive business landscape, every dollar counts. Whether you’re a nonprofit organization, government entity, or manufacturing company in Austin, understanding how to properly recover costs can mean the difference between thriving and merely surviving. This comprehensive guide explores cost recovery consulting and how it can transform your organization’s financial health.

What is Cost Recovery Consulting?

Cost recovery consulting is a specialized financial service that helps organizations identify, calculate, and recover indirect costs that are often overlooked or underutilized. These consultants work with businesses to develop systematic approaches for capturing expenses that should be reimbursed by grants, contracts, or supplier agreements.

At its core, cost recovery consulting focuses on maximizing revenue through proper cost allocation and recovery strategies. For Austin businesses, this service can unlock significant financial resources that were previously left on the table.

Understanding Indirect Costs: The Hidden Revenue Opportunity

Indirect costs are expenses that benefit multiple projects or organizational activities but aren’t directly traceable to a specific program or service. These costs typically include:

- Administrative overhead

- Facility maintenance and utilities

- Information technology support

- Human resources functions

- Financial management services

- General office supplies and equipment

Research shows that indirect costs can average 30% to 40% for government entities, representing substantial revenue opportunities when properly recovered.

Types of Cost Recovery Consulting Services

1. Cost Allocation Plan Development

Professional consultants help organizations create comprehensive cost allocation plans that comply with federal regulations, particularly 2 CFR Part 200 for entities receiving federal funding. These plans establish systematic methods for distributing indirect costs across programs and funding sources.

2. Indirect Cost Rate Calculation and Negotiation

Cost recovery consultants calculate accurate indirect cost rates based on historical data and projected expenses. They also negotiate with funding agencies to establish Negotiated Indirect Cost Rate Agreements (NICRA) that maximize reimbursement opportunities.

3. Supplier Recovery Services

For manufacturing and OEM companies, cost recovery consulting includes developing processes to recover costs from suppliers for defective or non-compliant parts. This specialized service can increase supplier recovery revenues by 3-5 times through structured, data-driven approaches.

4. Grant Funding Optimization

Consultants help organizations maximize grant funding through proper indirect cost recovery, ensuring compliance while capturing all allowable expenses.

Industries That Benefit from Cost Recovery Consulting

Government and Public Sector Organizations

State, local, and tribal governments often struggle with cost allocation due to limited resources and complex compliance requirements. Cost recovery consulting helps these entities:

- Reduce reliance on General Fund dollars

- Improve fiscal health and sustainability

- Maintain transparency in budget processes

- Make informed strategic planning decisions

Nonprofit Organizations

Nonprofits face unique challenges in balancing mission delivery with financial sustainability. Cost recovery consulting enables these organizations to:

- Recover unspent dollars from grant programs

- Demonstrate true program costs to funders

- Improve long-term program sustainability

- Enhance budget planning capabilities

Manufacturing and OEM Companies

Manufacturers, particularly in automotive, aerospace, medical device, and heavy equipment industries, benefit from supplier cost recovery services that:

- Reduce manual claim processing by up to 70%

- Improve supplier accountability and negotiation leverage

- Enhance compliance and audit readiness

- Generate significant return on investment

Parks and Recreation Departments

Recreation departments use cost recovery consulting to:

- Analyze program financial performance

- Develop defensible pricing strategies

- Build community support for programs

- Achieve sustainable revenue models

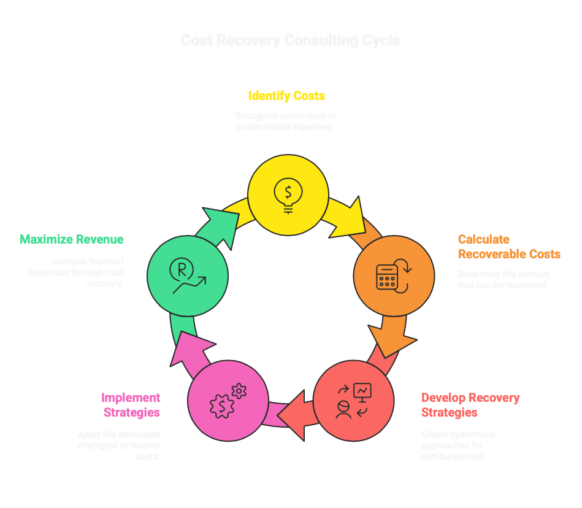

The Cost Recovery Consulting Process

Phase 1: Financial Assessment and Analysis

Consultants begin by conducting comprehensive reviews of existing cost structures, identifying all indirect costs and potential recovery opportunities. This includes analyzing historical data, current procedures, and compliance requirements.

Phase 2: Cost Allocation Plan Development

Based on the assessment, consultants develop customized cost allocation methodologies that align with organizational needs and regulatory requirements. This phase includes mapping indirect costs to appropriate cost centers and funding sources.

Phase 3: Rate Calculation and Documentation

Accurate indirect cost rates are calculated using approved methodologies, with comprehensive documentation to support negotiations with funding agencies or internal stakeholders.

Phase 4: Implementation and Training

Consultants work with organizational staff to implement new processes, providing training on cost tracking, reporting, and ongoing maintenance of cost recovery systems.

Phase 5: Ongoing Support and Optimization

Many consulting relationships include ongoing support to ensure continued compliance, rate updates, and process improvements as organizations evolve.

Technology Solutions in Cost Recovery Consulting

Modern cost recovery consulting increasingly incorporates advanced technology solutions:

Automated Workflow Systems

Software platforms streamline cost allocation processes, reducing manual effort and improving accuracy. These systems can automate claim processing, track recovery rates, and generate compliance reports.

Data Analytics and Business Intelligence

Advanced analytics tools help identify cost recovery opportunities, predict financial outcomes, and optimize pricing strategies based on real-time data.

Integration Capabilities

Modern solutions integrate with existing financial systems, ensuring seamless data flow and reducing duplicate data entry requirements.

Measuring Success: Key Performance Indicators

Effective cost recovery consulting delivers measurable results:

Recovery Rate Improvements

Organizations typically see significant increases in cost recovery rates, with some achieving 3-5 times higher recovery revenues.

Process Efficiency Gains

Automation and improved processes can reduce manual processing time by 70% or more, freeing staff for strategic activities.

Financial Impact

The investment in cost recovery consulting typically pays for itself through increased revenue, often achieving positive ROI within the first year.

Compliance Enhancement

Improved documentation and processes reduce audit risks and enhance regulatory compliance.

Common Challenges and Solutions

Challenge: Limited Internal Resources

Many organizations lack the specialized knowledge or staff time to develop comprehensive cost recovery programs.

Solution: Outsourcing to experienced consultants provides access to expertise without adding permanent staff costs.

Challenge: Complex Regulatory Requirements

Compliance with federal cost principles and audit requirements can be overwhelming.

Solution: Specialized consultants stay current with regulatory changes and ensure ongoing compliance.

Challenge: Stakeholder Buy-in

Securing support from leadership and funding agencies for cost recovery initiatives.

Solution: Consultants help develop compelling business cases and presentation materials that demonstrate value.

Selecting the Right Cost Recovery Consultant

When choosing a cost recovery consulting partner, consider:

Industry Experience

Look for consultants with specific experience in your industry and organizational type. Government entities need consultants familiar with federal compliance requirements, while manufacturers need expertise in supplier recovery processes.

Track Record

Evaluate the consultant’s history of successful implementations and client satisfaction. Request case studies and references from similar organizations.

Technology Capabilities

Ensure the consultant can provide or integrate with modern technology solutions that enhance efficiency and accuracy.

Ongoing Support

Consider whether you need one-time project support or ongoing partnership for rate updates and process optimization.

The Future of Cost Recovery Consulting

Cost recovery consulting continues to evolve with advances in technology and changing regulatory environments:

Artificial Intelligence Integration

AI-powered systems are beginning to automate cost identification and allocation processes, further improving efficiency and accuracy.

Predictive Analytics

Advanced analytics help organizations predict future cost recovery opportunities and optimize resource allocation.

Cloud-Based Solutions

Cloud platforms provide greater accessibility and collaboration capabilities for distributed teams.

Return on Investment: Making the Business Case

Organizations consistently report strong returns on cost recovery consulting investments:

- Immediate Revenue Impact: Many organizations recover their consulting investment within months through increased reimbursements

- Long-term Sustainability: Proper cost recovery practices create sustainable funding models that support organizational growth

- Risk Mitigation: Improved compliance and documentation reduce audit risks and potential penalties

- Strategic Advantage: Better understanding of true costs enables more informed pricing and strategic decisions

Getting Started with Cost Recovery Consulting

If your Austin-based organization is ready to explore cost recovery opportunities:

- Assess Current Practices: Review existing cost allocation and recovery processes to identify gaps and opportunities

- Quantify Potential Impact: Estimate the value of unrecovered costs in your organization

- Research Consultants: Identify consulting firms with relevant experience and strong track records

- Develop Implementation Timeline: Plan for the time and resources needed for successful implementation

- Secure Stakeholder Support: Build internal consensus for the investment in cost recovery consulting

Conclusion

Cost recovery consulting represents a significant opportunity for Austin businesses to improve their financial health and sustainability. Whether you’re a nonprofit organization seeking to maximize grant funding, a government entity looking to reduce General Fund reliance, or a manufacturer wanting to recover supplier costs, professional consulting can unlock substantial revenue opportunities.

The key to success lies in partnering with experienced consultants who understand your industry’s unique challenges and can develop customized solutions that deliver measurable results. With proper implementation, cost recovery consulting doesn’t just improve your bottom line—it provides the financial foundation for long-term growth and success.

By investing in cost recovery consulting, Austin organizations position themselves for financial sustainability while ensuring they capture every dollar they’re entitled to recover. In today’s economic environment, this strategic approach to financial management isn’t just beneficial—it’s essential for organizational success.

Disclaimer

This blog post is provided by Austin Bookkeeping Hub for educational and informational purposes only. The content presented here should not be construed as professional accounting, financial, legal, or business advice. Austin Bookkeeping Hub is not a CPA firm, and the information contained in this article does not constitute professional consultation or recommendations specific to your organization’s circumstances.

Cost recovery consulting involves complex financial, regulatory, and compliance considerations that vary significantly based on your organization type, industry, funding sources, and applicable regulations. Before implementing any cost recovery strategies or making financial decisions based on the information presented in this article, we strongly advise you to:

- Consult with qualified CPAs, financial advisors, or specialized cost recovery consultants

- Seek professional guidance regarding compliance with applicable federal, state, and local regulations

- Obtain expert advice tailored to your specific organizational needs and circumstances

- Verify all information with appropriate regulatory bodies and funding agencies

Austin Bookkeeping Hub makes no representations or warranties regarding the accuracy, completeness, or applicability of the information provided. Each organization’s situation is unique, and professional consultation is essential for making informed decisions about cost recovery practices.