IMARC Group, a leading market research company, has recently released a report titled “Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End-User, and Region, 2025-2033”. The study provides a detailed analysis of the industry, including the trade finance market trends, growth, size, and industry growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How Big Is the global trade finance market?

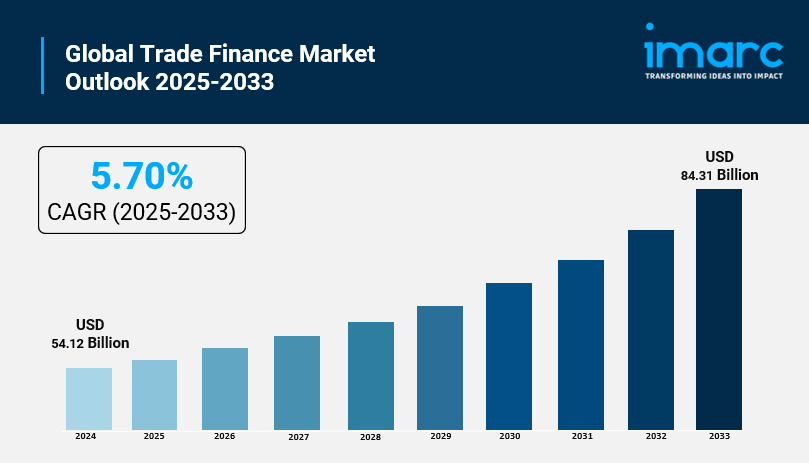

The global trade finance market size was valued at USD 54.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 84.31 Billion by 2033, exhibiting a CAGR of 5.70% during 2025-2033. North America currently dominates the market.

Growing Global Trade and Cross-Border Transactions

Trade finance market has been one of the trade finance market’s significant expansion areas through global trade. The cross-border transactions have been so frequent that the demand for the necessary financing that can manage import and export activities has risen dramatically. To properly manage such risks, companies require non-payment, currency fluctuations, and political instability to be affected in the least harmful manner possible. Over the year 2025, trade finance market has been experiencing wider usage due to trade facilitation requirements for the faster and more transparent kinds of processes. Financial institutions such as banks are constantly coming up with a variety of solutions to cater to the needs which may include the issuance of a letter of credit, supply chain financing, and export credit. On top of that, huge trade volumes in developing countries are fueling the demand for trade finance structured solutions that pave the way for small and medium enterprises to grow in foreign markets. The market is also benefitted by increasing awareness among corporates about the importance of risk management in international transactions.

Digital Transformation and Technological Integration

Digitization is significantly changing the trade finance market by bringing about operational efficiency and transparency. The use of blockchain, AI, cloud-based servicesfor financial institutions is on a steady rise, which is aimed at simplifying the trade finance processes, andachieving fraud prevention, which they are doing through decreasing the manual intervention. The use of several technologies is expected to bring about transaction expediency, real-time visibility, and smooth regulatory compliance. Digital platforms also give the opportunity for an improved interaction among the exporters, importers, and banks, hence a quick and hassle-free co-operation in the trade finance sector. The need for paperless documentation, smart contracts, and the use of automated workflows is increasing as businesses are more and more seeking a reduction in the cost and agility in the operation. Besides the excellent customer service, these technology advancements facilitate smaller players’ access to trade finance, who were previously disadvantaged.

Increasing Need for Risk Mitigation and Regulatory Compliance

One of the strategies that lead to higher trade finance market figures is risk management. Several threats are associated with international trade actions, including the risk of credit default, geopolitical tensions, and the volatility of foreign exchange markets. In 2025, the regulatory framework and compliance requirements are becoming more rigorous, urging companies to use organized trade finance instruments in cases of secure transactions. Among the products that financial institutions tailor for customers to choose from for effective risk mitigation are export credit insurance, forfaiting, and factoring. Moreover, trade finance arouses less anxiety in global stakeholders, thus, minimizing the unpredictability of the supply chain and ensuring ease of business operations. The strategy of risk management at the highest level among large corporates is instrumental in the expansion of this market and in the creation of demand for more sophisticated financial instruments.

Trade Finance Market Trends 2025

The trade finance market is currently undergoing changes which involve the use of digital and automated solutions as a way of improving customer satisfaction by the provision of efficiency and transparency in the trade process. Over the year 2025, blockchain-based platforms have become a popular choice for use as these provide a tamper-proof record of transactions and also help in reducing the reliance on the traditional paper-based processes. Artificial intelligence and machine learning technologies are being introduced in the areas of creditworthiness evaluation, identification of fraudulent activities, and the choice of the most optimal financing. In addition, there is a rising number of open account trade finance and supply chain financing businesses to facilitate the global trading activities of small and medium enterprises. Cooperation between banks and fintech is becoming more customer-focused and is very flexible, thus, the pairs can jointly develop innovative trade finance solutions which are very simple to be accessed by clients. The issue of sustainable trade finance is gaining momentum as well since financial institutions are planning to provide capital for use in less polluting businesses through green financing initiatives. At large, the market is graphing the direction towards the solutions that are speedier, safer and more accessible and are in line with participants’ latest expectations in international trade.

Get your Sample of Trade Finance Market Insights for Free: https://www.imarcgroup.com/trade-finance-market/requestsample

Trade Finance Market Segmentation:

Segmentation by Finance Type:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Segmentation by Offering:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Segmentation by Service Provider:

- Banks

- Trade Finance Houses

Segmentation by End-User:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Who are the key players operating in the industry?

The report covers the major market players including:

- Asian Development Bank

- Banco Santander SA

- Bank of America Corp.

- BNP Paribas SA

- Citigroup Inc.

- Crédit Agricole Group

- Euler Hermes

- Goldman Sachs Group Inc.

- HSBC Holdings Plc

- JPMorgan Chase & Co.

- Mitsubishi Ufj Financial Group Inc.

- Morgan Stanley

- Royal Bank of Scotland

- Standard Chartered Bank

- Wells Fargo & Co.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=2031&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302