IMARC Group, a leading market research company, has recently released a report titled “Automotive Start-Stop System Market by Component (Engine Control Unit, 12V DC Converter, Battery, Neutral Position Sensor, Wheel Speed Sensor, Crankshaft Sensor, Alternator), Fuel Type (Gasoline, Diesel, CNG, Electric), Vehicle Type (Motorcycles, Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global automotive start-stop system market Trends, size, share, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Automotive Start-Stop System Market Highlights:

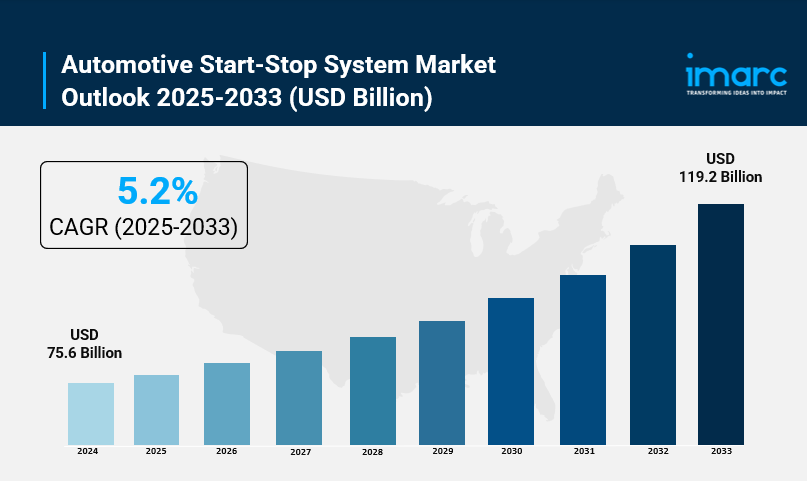

- Automotive Start-Stop System Market Size: Valued at USD 75.6 Billion in 2024.

- Automotive Start-Stop System Market Forecast: The market is expected to reach USD 119.2 billion by 2033, growing at an impressive rate of 5.2% annually.

- Market Growth: The automotive start-stop system market is experiencing steady growth driven by soaring fuel prices and the urgent need for vehicles that deliver better mileage in congested urban environments.

- Technology Integration: Advanced technologies like intelligent battery management systems, sophisticated engine control units, and low-noise starter motors are transforming how vehicles manage fuel consumption during idle periods.

- Regional Leadership: Asia-Pacific commands the largest market share, fueled by massive automotive production capacity and increasingly strict emission regulations in countries like China, Japan, and India.

- Fuel Efficiency Focus: With global fuel prices remaining volatile and environmental awareness growing, consumers are actively seeking vehicles that minimize fuel waste, particularly in stop-and-go city traffic.

- Key Players: Industry leaders include Continental AG, Denso Corporation, Robert Bosch GmbH, Valeo, Schaeffler Technologies, and Hitachi Astemo Ltd., which dominate the market with cutting-edge engine management solutions.

- Market Challenges: Cost sensitivity in emerging markets and consumer concerns about engine component durability present ongoing challenges for widespread adoption.

Claim Your Free “Automotive Start-Stop System Market” Insights Sample PDF: https://www.imarcgroup.com/automotive-start-stop-system-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Surging Demand for Fuel-Efficient Vehicles:

Similar to a past revolution in car design, car buyers are again becoming more concerned about the cost of fuel, since fuel prices have proved volatile on the world market. Car buyers want to know how to save money on fuel. Start-stop systems were developed to address this problem, stopping the engine whenever the vehicle becomes stopped for more than a few seconds, whether it is stuck in stop-and-go traffic, waiting at a stop light, or some other reason. Because of their simplicity, start-stop systems are often a very effective way to reduce fuel consumption during urban driving, where vehicles may spend a third or more of their time stopped. The system works very efficiently with urban and stop-and-go driving. The advantage of the technology is that it requires no change to the driving style of the user. The system works almost invisibly by switching off the engine whenever the car comes to a halt and switches back on as soon as the driver takes his or her foot off the brake or uses the clutch. The technology also helps manufacturers meet tightening corporate average fuel economy standards mandated by governments around the world.

- Revolutionary Advances in Engine Management Technology:

The earliest start-stop systems relied on fault-prone engine management technology, but the new generation of start-stop systems uses clever battery management systems to monitor the health, state of charge and temperature of the battery in real time to ensure reliable restarts of the engine. Today’s engine control units are able to communicate with the battery, alternator, sensors and starter motor to make the engine restart smoothly and almost instantly. One of the biggest improvements for start-stop systems is the introduction of low noise starter motors as these help to eliminate the noise and vibrations from older systems. More advanced starter motors, rated to start the engine hundreds of thousands of times, are also available. These counteract any concerns that an early version of the system would wear the engine heavily. Preferential use of the start-stop system can be decided by analysis of the driver’s driving style/road conditions, the vehicle battery, cabin climate and vehicle motion. Other more recent innovations have coupled start-stop with regenerative braking systems that recover energy when a vehicle slows down and then use this energy to charge the battery and power the start-stop system. As a result, start-stop has gone from being a somewhat controversial development to one that is generally accepted as part of the battery charging cycle in more modern vehicles.

- Explosive Growth of Hybrid Vehicle Platforms:

The automotive industry is undergoing common electrification efforts as manufacturers hurry to implement electrification strategies. Fully electric vehicles operate by a different model. However, hybrid electric vehicles and plug-in hybrids have made use of advanced start-stop systems to provide additional benefits of electrification over a purely internal combustion engine. These models typically have a start-stop control for automatic switching between an internal combustion engine and an electric motor with complex powertrain systems in the drive train. These vehicles are capable of travelling in pure electric mode at low speeds in towns or at a stop and can switch over to engine power as required. Hybrids, although considered different from start-stop vehicles, can be viewed as a good intermediate compromise. Range anxiety delays the adoption of electric vehicle technologies in markets where charging infrastructure for electric vehicles is limited. The efficient start-stop system used to supplement a hybrid vehicle can ease this concern. It allows for fuel and emissions reductions when needed without disrupting drivers’ refueling habits or battery range. Auto manufacturers around the world have spent billions developing hybrids. As most consider hybrids the bridge to electrification, demand for such advanced start-stop systems will remain high as hybrids are built for years to come. As 18 car makers now offer automatic start-stop systems as standard equipment across entire product lines, their business case has been made for manufacturers and consumers.

- Stringent Emission Regulations Driving Adoption:

In response to climate change and urban air pollution, governments have been setting progressively stricter vehicle emissions targets, changing the priorities of automotive development, and accelerating the introduction of technologies such as start-stop and other vehicle efficiency improvements. The European Union has been responsible for some of the world’s most stringent carbon pollution standards, effectively forcing car manufacturers to fit their vehicles with fuel economy technology as standard equipment. China and India, Asian countries with real air pollution issues, are starting to follow. In fact, even in places wherein emissions standards are more lax, standards are tightening as concerns over environmental issues and these emissions begin to take a higher political priority. Therefore, vehicle manufacturers find start-stop one of the cheapest ways by which they meaningfully reduce emissions without developing a completely new powertrain. It can be retrofitted to existing engine ranges. Electric and hydrogen powertrains require new infrastructure for construction. This creates a regulatory environment for automakers that provides clear incentives to implement start-stop across their ranges even when market forces alone fail to justify the cost and complexity of such a technology for specific applications.

Automotive Start-Stop System Market Report Segmentation:

Breakup by Component:

- Engine Control Unit

- 12V DC Converter

- Battery

- Neutral Position Sensor

- Wheel Speed Sensor

- Crankshaft Sensor

- Alternator

Wheel speed sensor represents the largest segment, serving as a critical component that provides real-time data about vehicle motion to determine optimal timing for engine shutdown and restart.

Breakup by Fuel Type:

- Gasoline

- Diesel

- CNG

- Electric

Gasoline accounts for the largest market share, reflecting the continued dominance of gasoline-powered vehicles in global automotive markets and the widespread integration of start-stop technology in these vehicles.

Breakup by Vehicle Type:

- Motorcycles

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars lead the market, driven by the massive scale of global passenger vehicle production and consumer demand for fuel-efficient personal transportation options.

Breakup by Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Original equipment manufacturer (OEM) dominates the distribution landscape, as start-stop systems are increasingly installed as factory-equipped features integrated deeply into vehicle engine management systems.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific commands the largest regional share, benefiting from the region’s position as the world’s automotive manufacturing powerhouse and the implementation of progressively stricter emission regulations across major markets.

Who are the key players operating in the industry?

The report covers the major market players including:

- Continental AG

- Denso Corporation

- Hitachi Astemo Ltd. (Hitachi Ltd.)

- Maxwell Technologies Inc. (UCAP Power Inc.)

- Robert Bosch GmbH (Robert Bosch Stiftung GmbH)

- Schaeffler Technologies AG & Co. KG

- Valeo

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=7384&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302